Simple

Or perhaps not

A couple of weeks ago when things were… well not necessarily more normal than today but perhaps less economically chaotic, Donald Trump seemed to indicate a willingness to have America become an associate member of the British Commonwealth. Cue a thousand wags on Twitter posting gifs of King George III singing ‘You’ll Be Back’ from the musical Hamilton.

But now the British Invasion is real, in terms of Americans having realised over the last couple of days that they might have ‘done a Brexit’. The Wall Street Journal, erstwhile conservative paragon, now apparently leader of #theresistance, just published a piece comparing Trump’s benighted tariff-raising Liberation Day to Britain’s experience after the Brexit vote in 2016. This article has the amusingly euphemistic subtitle “Britain’s decision to raise barriers with its largest trading partners has broadly come to be seen as an act of economic self-harm”. Yes.

It is of course entirely possible, after the S&P500 fell over ten percent in two days following Trump’s tariffs, that the tariffs are altered over the weekend or in coming weeks, although I suspect Trump’s ego is stronger than the stomachs of Wall Street titans. Presuming though that the tariff related chaos continues, the United States does appear to be following Britain in engaging in an act of anti-elite economic self harm.

But that’s not the parallel I wish to draw. Instead I want to focus on a related similarity - the temptation by both Brexiteers and tariff-proponents to wish away complexity and argue that getting to their desired goals is, to use a term that always ends their tweets, ‘simple’.

In Britain, before and after the referendum, we became achingly familiar with the argument that Brexit would be easy, would be ‘simple’. Liam Fox, then international trade secretary, pronounced in 2017 that the trade deal should be ‘the easiest in human history’. Arch Brexiteer John Redwood claimed in 2016 that “getting out of the EU can be quick and easy – the UK holds most of the cards”. Michael Gove anted up to Britain holding “all of the cards”. Nigel Farage argued that “to me, Brexit is easy.” And my favourite of all, then UKIP spokesman Gerard Batten argued that a Brexit deal could be sorted out “in an afternoon over a cup of coffee”.

Sounds great lads, how did it go?

This kind of ‘simples’ rhetoric became quite prevalent on the British right for a few years. Some of it was run-of-the-mill FADFO - you can make major changes and nothing bad will happen because someone else will sort it out probably. Some of it was a theory of disruption that had little patience for liberals talking about complex supply chains and what not and argued for moving fast and breaking things.

And some of it was, and here I psychoanalyse a bit, a bunch of well-to-do older guys who had never had anyone tell them not to do things they wanted to do. It was a chat in the pub after last orders, setting the world to rights.

Cast forward a few years and we are doing this again but now at the heart of the global economy. The United States has decided to raise trade barriers not just against one major regional trading partner. No, that’s for babies. It has raised them against every country in the world - save of course for Russia, Belarus, North Korea and Cuba - often by eye-watering amounts, as in the case of China, Vietnam and Cambodia.

The US has raised tariffs against, inter alia, uninhabited islands full of penguins, an Indian Ocean island whose residents are solely members of a US military base, a Pacific island that was confused with the English county of Norfolk. Oh and in passing, the US has also accidentally recognised Taiwan as a country, breaking with decades of American foreign policy.

The global reaction has not been entirely encouraging. Stock markets have plummeted. Particularly badly hit have been America’s big tech titans - Apple has lost 13% in the last couple of days, NVIDIA and Amazon around ten percent - and private equity / venture capital firms such as KKR (down 17%) BlackRock (12%) and Apollo (18%). All told around $2 trillion dollars has been wiped from the US stock market.

So how did this happen? We all knew Trump wanted tariffs but what surprised markets was just how dumb the tariffs might be. How simple. People had thought that we would be seeing The Art of the Deal, as Trump negotiated with each trading partner to get them to lower their own tariffs in response to the threat of US ones.

We had after all seen quite a bit of that in Trump 1.0 and also in the varied threats to Colombia, Canada and Mexico at the start of his new term. And yet we have seen over his weeks in office, Trump already doubling down - with Mexico and Canada, despite their existing trade agreement negotiated by Trump, having tariffs already imposed and not negotiated away.

Trump had threatened across the board tariffs and reciprocal tariffs during his campaign. But again people thought the across the board part might be quite low and if not low at least not also paired with reciprocal tariffs. They had also imagine that reciprocal tariffs might be just that - carefully calibrated to the actually existing tariff and non-tariff barriers that other countries had in place.

But, according to Jeff Stein at the Washington Post, that’s not how Trump opted to go. Instead he picked an option that followed a simple formula that owed rather a lot to a 2011 book by his trade advisor Peter Navarro. The formula was so simple that within an hour or so James Surowiecki had figured it out.

It was this simple - take the US trade deficit with a country, divide it by imports from that country, and then divide by two. If that number is less than ten percent, round up to ten percent. If the country is in the EU, just call it twenty percent.

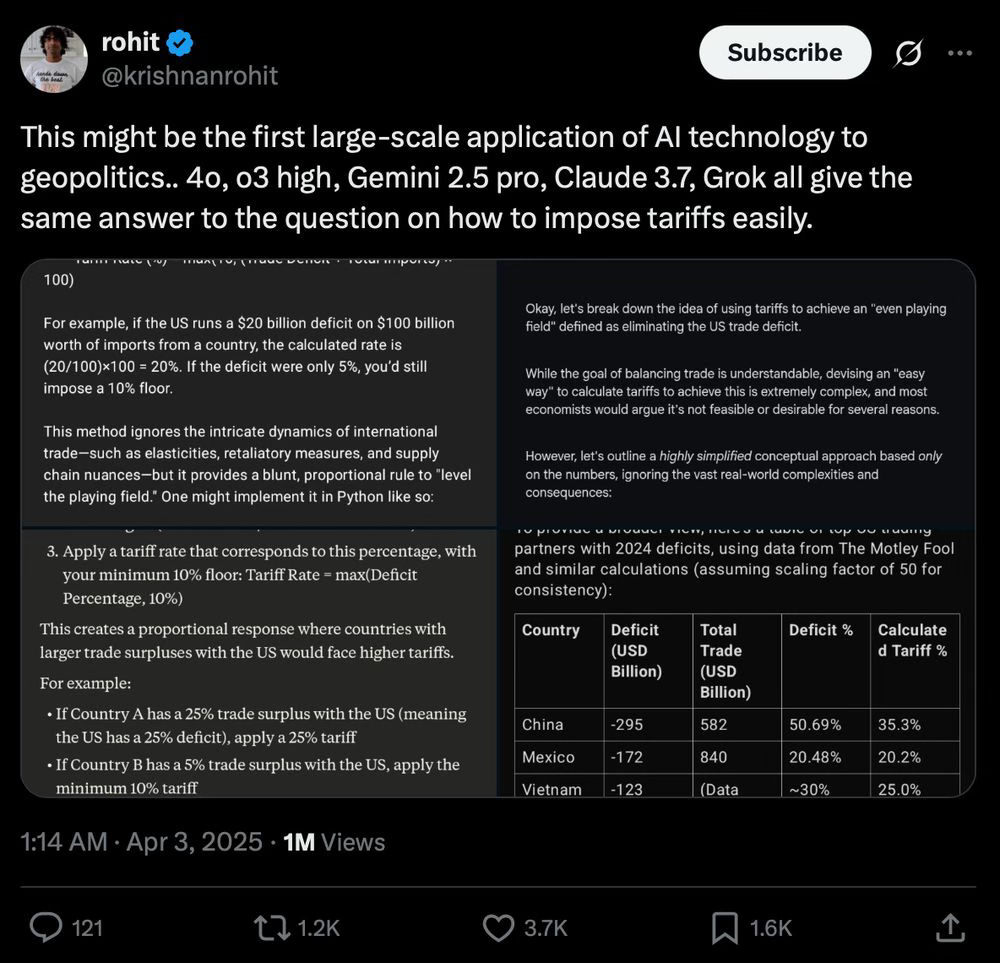

On Twitter there was much speculation that the formula had come from asking ChatGPT or other LLMs how to cancel out the US trade deficit with any country. But it turned out that the source these LLMs was drawing on was Peter Navarro’s own book, which then suggests that the LLMs were ‘coming from inside the house’. On the LLM theory, though, see the picture below from Rohit Krishnan.

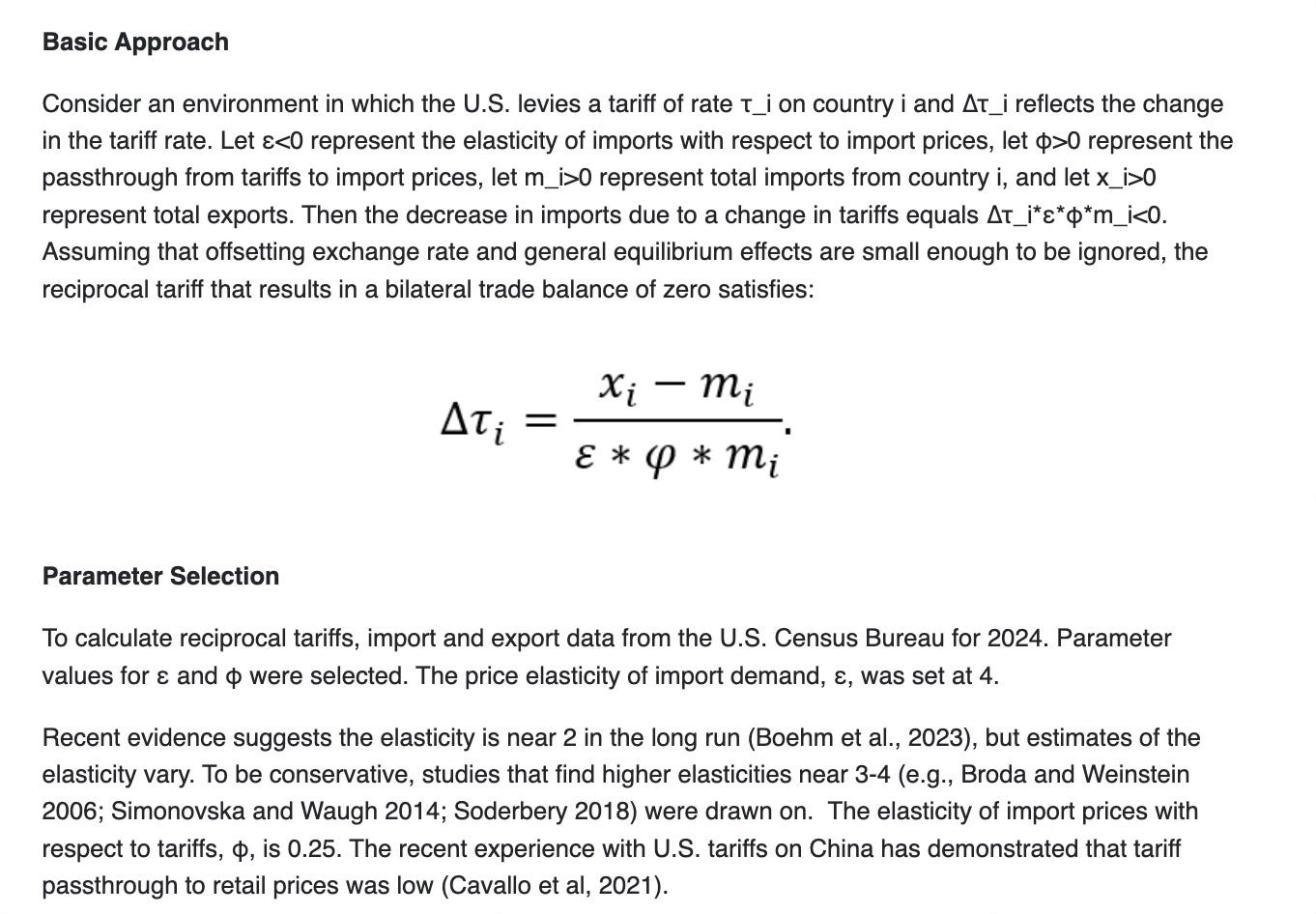

Regardless of the exact source of the formula things got more stupid from there. People were incredulously asking, ‘surely the formula is not that dumb?’ and the White House responded by saying of course not, it comes from a more complicated equation developed by our council of economic advisors. Here is their writeup of said equation.

A couple of things to note. First, the equation is missing a minus sign (tariffs should not go up when exports are higher than imports, or if this works because one of the elasticities in the denominator is negative then the text below should say that). Second, this looks very rushed, what with the variables having subscripts in the equation but the markdown version of subscripts in the text (i.e., writing things as x_i). Some people have noted that this is a common outcome when you ask LLMs to write things up. Who’s to say…

But there is a more important critique. Remember the Surowiecki claim was that Trump’s tariffs came from taking the trade deficit divided by imports (and then dividing by two to give the US ‘reciprocal’ tariff). Obviously there was a bit of panic at the White House when their mystery equation was solved. So they claimed no no no there is real economics here - look we have the price elasticity of import demand (how much the quantity imports responds to tariffs) and the elasticity of import prices with respect to tariff size (how prices respond to tariffs). They even have Greek letters! Epsilon and phi no less. Strong letters. Great letters. A lot of people have talked about how great these letters are.

So we start with epsilon (price elasticity of import demand). Which most people think is probably two. But ‘estimates of the elasticity vary’. Sometimes up to four. Let’s be conservative - we are good conservatives after all - and call it four. Now what about the elasticity of import prices with respect to tariffs - our friend phi? Well that’s probably 0.25 because there wasn’t much passthrough last time we raised tariffs.

And what do 4 and 0.25 multiply to?

Oh how very convenient. They cancel out and the denominator is just imports. Much like Surowiecki’s initial guesstimate about the equation.

Simple.

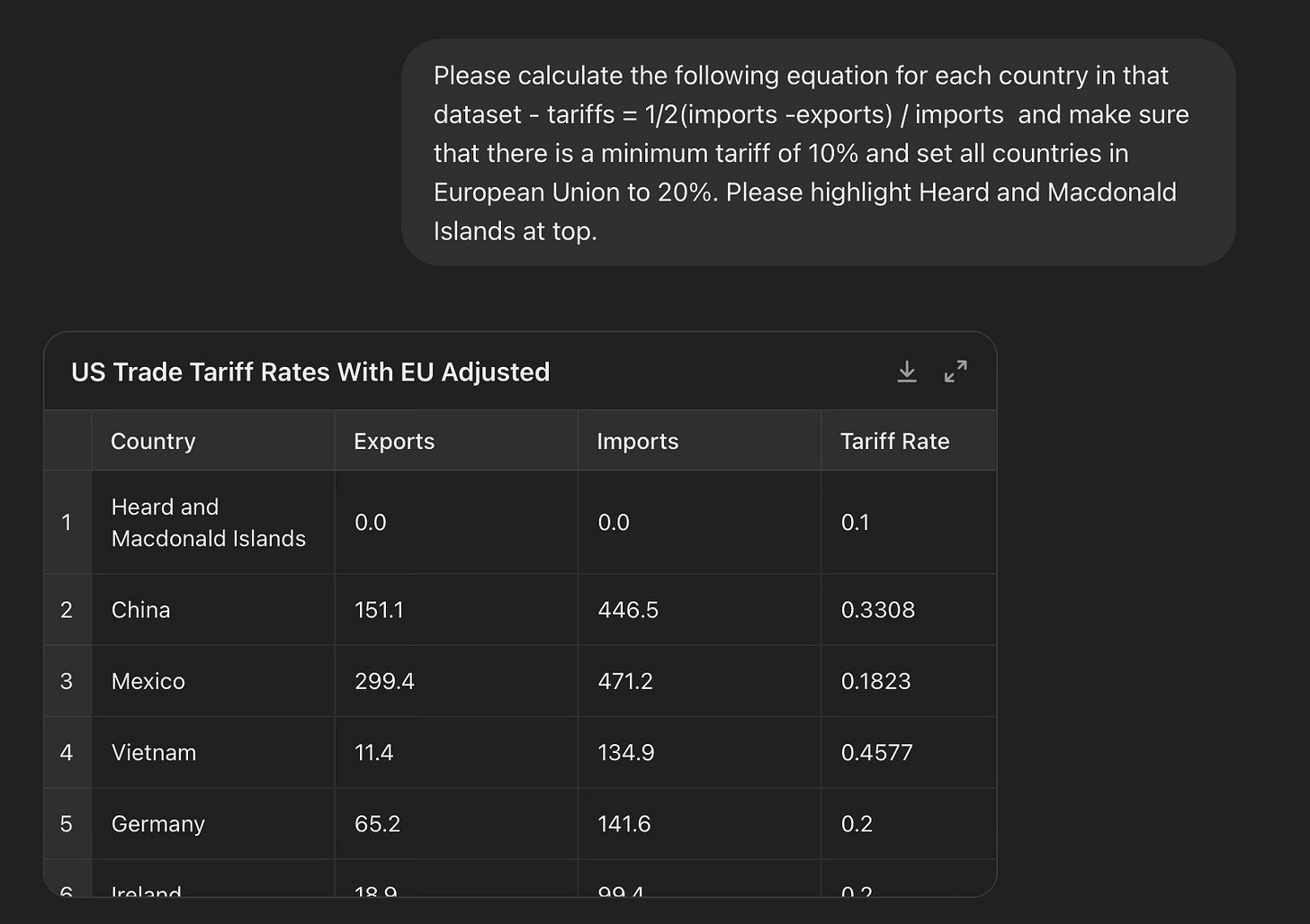

But there’s more. Now we have our refined equation how should we calculate our tariff schedule. Well we need a database of countries. Maybe we could find that by asking ChatGPT for a list of US trade deficits. If we do (and I did), we get a Census webpage here. One can then ask an LLM to use this equation on that dataset - making sure to have a minimum of 10% and give EU countries 20% - and produce a tariff schedule. We will of course calculate tariffs for every country that is on the list. Here’s one I made earlier.

I decided it was important to highlight a particular ‘country’ - the human-uninhabited but penguin-very-much-inhabited Heard and Macdonald Islands, which are Australian external territories, and also happen to be in the Census website list I linked to above. So that’s why they appeared. It’s also likely why Taiwan appeared since it has its own entry on the website too. And British Indian Ocean Territory (aka the US/UK Diego Garcia military base). And so forth. Note also that we get very similar tariffs to the ones that China and Vietnam actually got.

Now, who knows exactly how the White House team drew up their list of countries on whom tariffs were to be applied. But it doesn’t seem they put much time or effort into it. Because, you know, it’s simple.

How has the MAGA base responded to the threat of tariffs deepsixing the US economy? By saying that the pain is worth it to re-industrialise America. Marco Rubio was out there acknowledging the markets were indeed crashing but arguing in the long run this was a price worth paying.

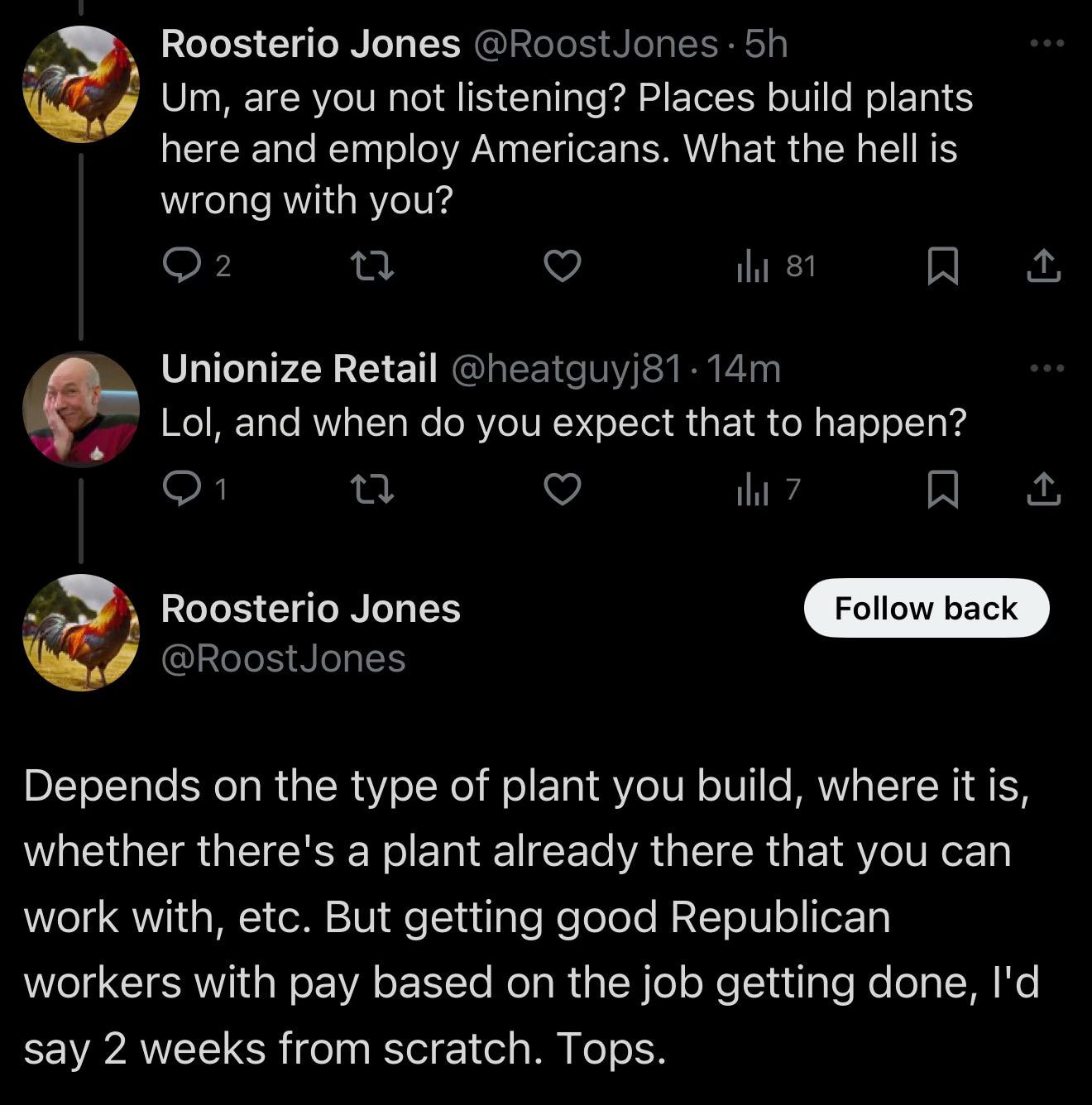

And a number of MAGA folk on Twitter were fairly sure that America could re-industrialise pretty quickly. Here is a particularly amusing exchange:

Two weeks. Simples.

What about that most frightening of possibilities - Nintendo Switch 2 preorder being delayed because of tariffs. Don’t worry we just reshore Switch production to Ohio.

Two months. Simples.

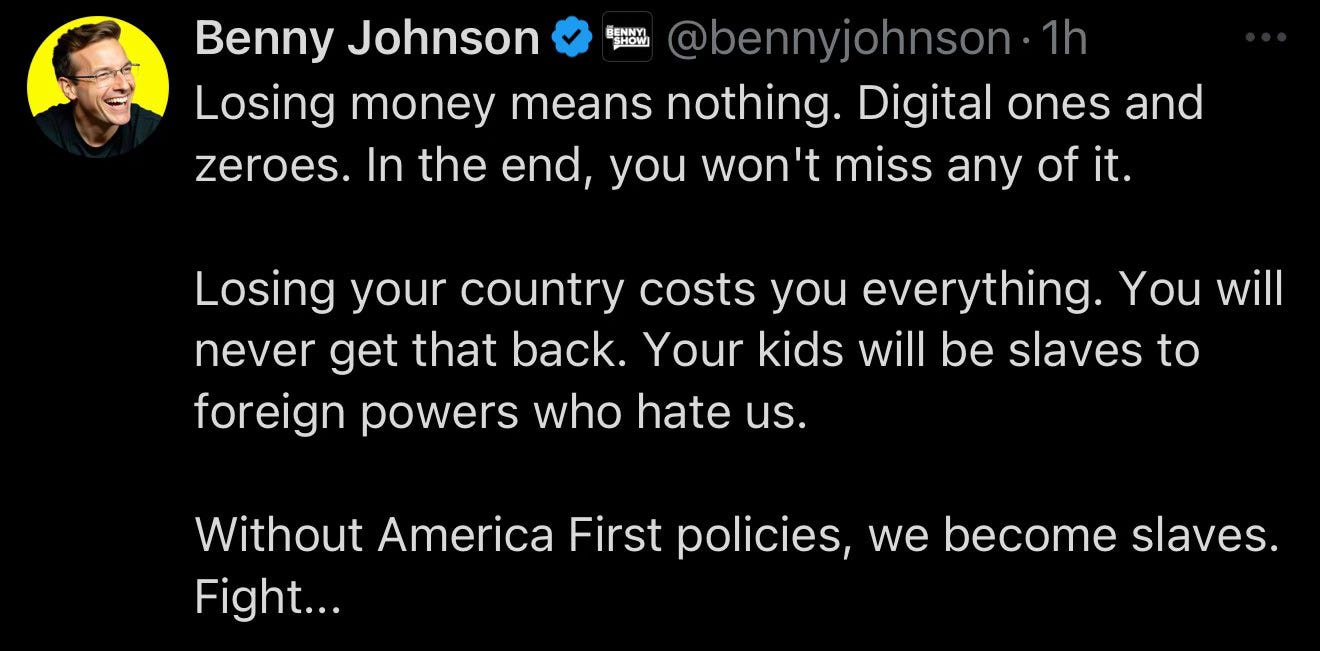

Other MAGA influencers are denouncing people for being upset about a little bit of economic turbulence.

Zeroes and ones baby. Simples.

Brexit-appreciators will remember similar claims from a few years ago. The Times had an article on growing your own vegetables in the event of a No Deal Brexit. The then environment secretary (soon to be Deputy PM) Therese Coffey argued Brits needed to love our seasonal turnips. And Jacob Rees Mogg, the Benny Johnson de nos jours passés, argued that we would not experience the full benefits of Brexit for up to possibly fifty years.

Brexit was simple you see. And if it wasn’t well it was a price worth paying. So shut up. It’s all simple. Can’t you see?

We will, I imagine, learn about the effects of Trump’s tariffs in fewer than fifty years. But one consequence of the last few days is already clear. When it comes to the transatlantic passage of a passion for simplicity and a desire to ignore immediate negative consequences, Brexit Britain is very much a model for Trump’s tariffs.

Harold Macmillan’s vision has truly been realised. At last we are the Greeks to America’s Roman Empire.

Simple.

The Trump Slump should be great for reducing carbon dioxide emissions and thus slowing global warming.

Thanks Donnie.

Appreciated your article, Ben.

Keep it “simple” for popular consumption (good politics, perhaps), ignore complexity (bad economics).

Which ever tariff equation was used ( robust or otherwise) this only addresses first-order direct effects.

Policy set by grown ups based on “best practice” would automatically consider second-order indirect effects (e.g. price inflation), and third-order induced effects (e.g. lower growth/recession). Yet more complexity! Simples.